Like people, states have to make a budget, which means estimating their expected income and spending. A state must also balance its budget based on the revenue it expects to earn. A state's revenue is limited, but its needs are endless. It must therefore manage its finances properly to fulfil its role effectively.

The main sources of revenue for a state are income taxes and royalties paid by the population and businesses.

Royalties are amounts of money that a company or state must pay to another state in exchange for the right to exploit a resource.

A country’s main expenses are:

-

investing in infrastructure;

-

funding social programs and services, such as education, health care, social assistance or employment insurance;

-

supporting business development;

-

military spending (the army).

Developed countries usually invest in social programs. Although costly, these programs ensure a certain standard of living for the population and ultimately contribute to wealth creation. On the other hand, developing countries have to invest a lot of money in building infrastructure to develop their own industries.

Regardless of a country’s level of development, the state may need to spend on a number of things. If spending is greater than income, the state’s budget is in deficit, the country goes into debt and must find a way to repay it.

To reduce its public debt, a state can increase its revenue (taxes collected from the population and businesses) and reduce its spending (investments in infrastructures and social programs as well as military spending). This should allow it to rebalance its budget and free up money to repay its debt without having to take out new loans. However, if these efforts are not sufficient to allow the state to repay its debt on its own, it will have to borrow money to repay the debt.

A state borrows funds by turning to financial markets. Through exchanges of financial products, these markets allow investors to invest their savings and allow companies and states to finance their debts, among other things. The funds they borrow can come from many different sources around the world:

-

Other wealthier states

-

Banks

-

International organizations, such as the World Bank (WB) or the International Monetary Fund (IMF)

-

Wealthy private investors

-

Citizens

A financial market is a physical or virtual place where people buy and sell financial products, such as company stocks or bonds.

The interest rate for these loans is determined by the state’s credit score. To determine this credit score, financial experts assess the state’s ability to pay back the sum it borrowed. If the experts find that the state has the financial capacity to pay back its debts, the risk of lending it money is lower. Since the risk is low, the state’s interest rate will be low. On the other hand, loans considered riskier by experts will have a higher interest rate.

Regardless of the source of the loan, the state will have to pay interest on the amount it borrows. A higher interest rate means that the final amount to be paid back will be higher. High interest places an additional burden on the state’s finances and makes it even more difficult to repay the debt.

The interest rate refers to the amount a person or institution has to pay to access a loan. This amount is calculated as a percentage.

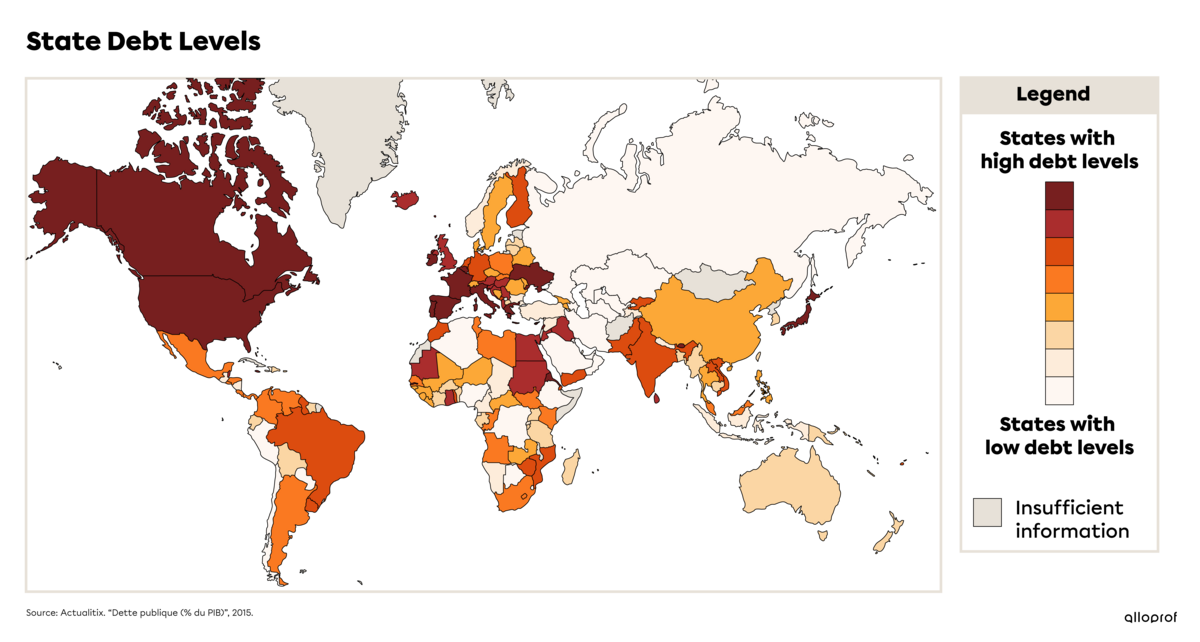

Not all states have the same level of debt. Some states are heavily indebted, while others have a much smaller debt. This debt is called public debt.

Public debt refers to all money borrowed by a state.

To determine the impact public debt has on a state’s economy, it is useful to compare it to the Gross Domestic Product (GDP). The same amount of public debt has a much bigger impact on a state with a lower GDP than a state with a higher GDP. Along the same lines, the same amount of debt is easier for a person with a high salary to pay back than a person with a lower salary. This calculation of the debt burden is generally expressed as a percentage of GDP. For example, a debt representing 20% of a state’s GDP is considered low, whereas a debt of 80% or even 110% of GDP means that the state is heavily in debt.

If a state can adjust its economy to meet its financial obligations, in particular by generating enough money to pay its creditors, its public debt is unlikely to cause any real problems. It can lower its debt little by little with each payment.

However, this is not possible for all states. The more debt a state has, the more problems it can cause for its economy. Just like a person, it has to repay its debts, but when the debt is high, it becomes difficult to do so with its own revenue. Sometimes, the state has no choice but to take out a new loan to pay for what it needs to keep functioning, and to repay its debts that are coming due. As a result, instead of resolving the problem, it goes further into debt.

The financial problems caused by a heavy public debt can have major consequences for the population and businesses. The state has to devote a lot of its budget on debt repayment, leaving less money to invest in infrastructure development or social programs. The state must rebalance its budget through austerity measures. These measures aim to reduce state spending on infrastructure, aid programs or social programs.

Austerity refers to all measures taken by a state to reduce its spending and balance its budget, particularly to reduce its debt.

One possible consequence of austerity measures is the privatization of some public services, meaning the state entrusts private companies with services that it used to provide. An example of privatization is the reduction of state-funded health care. This means that people have to pay for health care out of their own pocket. Privatization often leads to greater disparity among the population, as these services, which were previously available to everyone, now come at a price that not everyone can afford.

Greece is a developed country and part of the European Union. Over the years, the country accumulated a heavy financial debt. The 2008 global financial crisis shook this state’s very fragile economic balance.

To fix Greece’s dire situation, the International Monetary Fund, the European Union and the European Central Bank put in place a financial aid plan to prevent it from defaulting (inability to repay its debts) and help it rebuild its finances.

However, this aid came at a price. Greece had to considerably reduce its spending, including on social programs and public services, such as hospitals and schools. Unemployment and poverty rates increased greatly, hitting the population hard for many years.

Both developed and developing countries can be in debt. A state’s debt burden can vary over time.

In 2015, states such as Japan, France, the United States, Greece, Jamaica and Eritrea had debt ratios approaching or even exceeding 100% of their gross domestic product (GDP).

In the same year, other states had much smaller debts. These included Saudi Arabia, Algeria, Chile and Nigeria. Their debts represented less than 20% of their GDP. Some states had almost no debt. One example is Brunei, a state neighbouring Malaysia, which had a debt of about 2.6% of its GDP in 2018.

Giguère Groulx, Jean-Félix et Marie-Hélène Laverdière. Immédiat. Richesse, 2017, p.24-25.

Ladouceur, Maude et Alain Parent. Globe. Cahier d’apprentissage, 2014, p.179-182.