-

The stock exchange is where securities (stocks and bonds) are bought and sold by investors.

-

Stocks are ownership titles that represent a portion of a company’s capital.

-

Bonds are negotiable debt instruments issued by companies or governments in order to borrow money.

-

Capital is the assets or money owned by a person, company or state. Capital can be used to make investments.

Stock markets are a type of financial market that is key to economic and financial development. They attract capital and investments from around the world.

A financial market is a physical or virtual place where people buy and sell financial products, such as company stocks or bonds.

The high returns attract many investors, but these investments can be risky. Since the value of securities is not guaranteed, investors can lose their capital.

A financial security (share, bond, etc.) is a property right issued by a company or a state.

Source: Ancienne Bourse à Paris [Photograph], Peazapata, 2015, Wikimedia Commons, (URL). CC-BY-SA-4.0.

Some developing countries in South America have achieved economic success by participating in international stock markets, which attract foreign capital investment.

The value of securities, called the quotation, is unique and valid for all investors. It is also public knowledge. It defines the purchase and sale price. This quotation is established based on the market rules of supply and demand.

Sellers represent supply and buyers represent demand.

The stock value is negotiable and varies according to the market. Shareholders enjoy certain benefits, including dividends, voting rights at general meetings, the right to information, etc. These benefits are proportional to the fraction of capital held.

Julian owns 90 shares of Informatixus and for each share, the company pays a dividend of $1.40. When Informatixus pays the dividends, Julian receives $126.

Number of shares owned x Dividend amount for each share = Amount received

90 x $1.40 = $126

Bonds are securities sold by companies or governments to finance themselves by borrowing money. An investor who owns a bond will be repaid with interest by the company or government when the bond matures.

The stock market is constantly fluctuating. Fortunes can be lost as quickly as they are made. Investors speculate when they buy a stock by guessing which stocks will go up in value, and they sell when the stock value has gone up enough to make a profit when they sell it. Investing in the stock market is a profitable economic activity, especially in the long term.

Source: Eviart, Shutterstock.com

Investors must place an order to buy or sell securities. This order contains important information, including the action to be taken (buy or sell), the amount to be bought or sold, the deadline by which the order must be completed.

Investors generally have to go through financial intermediaries to participate in the stock market. These intermediaries can be banks, asset management companies or financial advisors. They transfer this information to a member of the exchange, in other words, a stock trader, stockbroker or exchange company.

Each stock exchange has a stock market index that provides its return on investment (performance) in relation to other stock exchanges.

This index is based on the value of representative equity, such as the performance of the largest companies. The stock market indexes provide a good idea of the general trend and performance of the market.

In 1896, two financial columnists, Charles Dow and Edward Jones, published the first stock market index. Their index is called the Dow Jones and is based on 12 representative equities of the New York Stock Exchange. Other stock market indexes were later created for several exchanges around the world.

The major world indexes are the DAX 30 (Frankfurt, Germany), created in the 1980s, the Dow Jones (New York, USA), created in 1896, the FTSE 100 (London, UK), created in 1984 and the NIKKEI 225 (Tokyo, Japan), created in 1949.

Source: Pavel Bobrovskiy, Shutterstock.com

The NASDAQ is an American stock exchange with several technology companies. It has played a major role in the international market since the 1990s. The NASDAQ index provides information on the performance of the American market.

Source: NASDAQ stock market displays at Times Square [Photograph], bfishadow, December 6, 2007, Wikimedia Commons, (URL). CC BY 2.0.

The Toronto Stock Exchange (TSX) is Canada’s main stock market index.

The concept of the stock market likely dates back to ancient times and the Middle Ages. However, the way it works today is the result of gradual changes to business processes, from urban development during the Middle Ages to the second phase of industrialization.

The first joint-stock company was officially created in 1372. People could buy shares in the company, which at that time was called Société des Moulins du Bazacle. The shareholders at the time were called pariers, and were entitled to dividends each year. They also made decisions about the company. For example, they would elect the members of the board each year.

The first French stock exchange was founded in Lyon in 1540. Other European cities would later create their own stock exchanges: Amsterdam in 1530, Berlin in 1685 and Vienna in 1771. The United States founded the New York Stock Exchange on Wall Street in 1792.

The French term for the stock market, bourse, comes from the name of a wealthy merchant family from Bruges, Belgium. The Van der Beurse family owned an inn frequented by merchants. Over the years, they not only housed merchants, but also participated in market activities by bringing buyers and sellers together. The square in front of the inn gradually became the main meeting place for checking exchange rates and making contracts. People started calling the square Ter Beurse (the stock exchange).

Market laws have always led to fluctuations in security values and there have been several events in history that have affected the stock market.

The first stock market crash occurred in Holland between 1636 and 1637. In the early 17th century, a new flower called the “tulip” was imported from Turkey. Soon, everyone wanted to plant this colourful flower in their gardens. Tulips were a sign of social and economic success. As tulips became more popular, many investors speculated that the value of tulip bulbs would rise. This meant they would buy tulip bulbs while trying to predict their future price in order to resell them at a higher price. This initially involved the rarest species of tulips. However, by the end of 1636, prices for tulip bulbs of simple species also began to rise. At its peak price, a tulip bulb was worth about 10 times the annual salary of a craftsman.

More speculators became interested in the tulip, until one day there were no more buyers, because the price of the tulip was far too high and tulips were no longer as rare as they were when the speculation started. Prices quickly dropped and investors who had bought bulbs at high prices lost a lot of money.

In 1716, Scottish economist John Law created the Banque Générale in Paris. This bank was linked to the Company of the West (or Mississippi Company), which was responsible for exploiting the Louisiana territory in America. Investors (buyers) could buy shares in this U.S. territory. The goal was to get the French kingdom out of debt and to pay back the shareholders with the money from the profits made from the Louisiana territory.

In 1718, the Banque Générale became the Banque Royale. At that time, John Law had a monopoly on money distribution in France. There was a lot of speculation in his company’s shares as investors bought large quantities of them.

In 1720, the bubble burst when investors realized that the notes issued by the Banque Royale were worth less than promised. The bursting of the speculative bubble bankrupted John Law and ruined the investors who had trusted him. After this rapid decline, investors became wary and reluctant to invest again. To restore the country’s economy, the King’s Council of State created the Paris Stock Exchange in 1724.

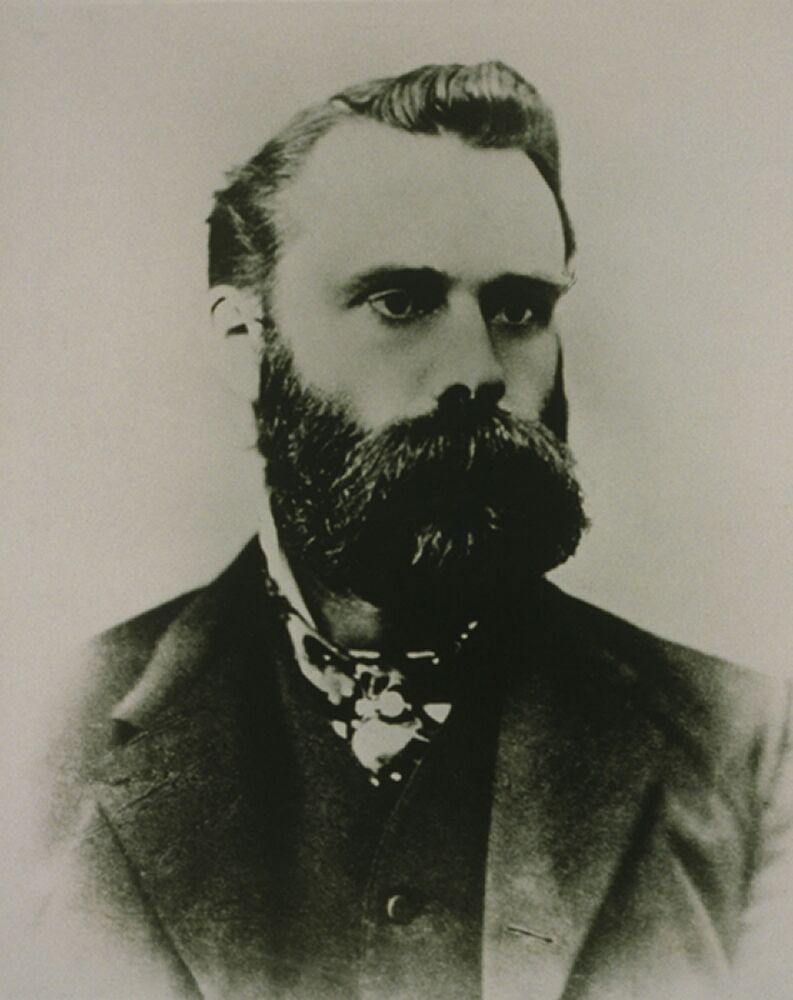

Source: John Law [Painting], Balthazar, C., n.d., Wikimedia Commons, (URL). CC0 1.0.

-

1830: The first railway company went public. The public offering of this company, and those of other railway companies that followed, allowed them to raise funds. This financing led to a major expansion of railway networks in the 19th century.

-

1873: The Vienna Stock Exchange crash was one of the causes of the global economic crisis that lasted until 1896. This crash was the result of a real estate speculation bubble on the Viennese market that bankrupted several banks in a row.

-

1929: The Wall Street Crash led to a global economic crisis called the Great Depression.

-

1971: A new stock market and a new stock index, the NASDAQ, were created in New York. This was the first digital market in the world.

-

1987: Black Monday marked a sharp decline in the Dow Jones (22.6% compared to 12.6% in 1929). This is still the biggest single-day drop in a stock market index. To find out more about the crash of 1987, see the article Black Monday: Definition in Stocks, What Caused it, and Losses.

-

2008: This financial crisis started in the United States and quickly spread across the globe. The crisis began when the housing bubble, created when real estate demand became much higher than supply, burst. This caused real estate prices to fall. Many people borrowed money at a very low rate to buy a house. Unfortunately, many of them couldn’t afford to repay their debts when interest rates started to rise. As a result, many people tried to sell their houses. As supply became much greater than demand, prices collapsed, and borrowers weren’t able to repay their debts to banks. The banks had taken risks by lending these people a lot of money. When these people were suddenly unable to repay their loans, the banks were in trouble. Some of them ran out of money and had to declare bankruptcy. To find out more about this financial crisis, see 2008-09 Recession in Canada.

Balthazar, C. (n.d.). John Law [Painting]. Wikimedia Commons. https://commons.wikimedia.org/wiki/File:John_Law-Casimir_Balthazar_mg_8450.jpg

Bfishadow. (2007, December 6). NASDAQ stock market displays at Times Square [Photograph]. Wikimedia Commons. https://commons.wikimedia.org/wiki/File:NASDAQ_stock_market_display.jpg

Peazapata. (2015). Ancienne Bourse à Paris [Photograph]. Wikimedia Commons. https://commons.wikimedia.org/wiki/File:Ancienne_Bourse_%C3%A0_Paris.JPG