This concept sheet focuses on the economic side of the Great Depression and its causes.

To find out more about this topic, see the concept sheet on the stock market crash and the Great Depression.

After World War I, people rejoiced as soldiers finally returned home and the economy strengthened. Economic growth was stimulated by increased consumption that began at the end of the war. People were starting to live again without fear and without having to ration certain goods like they did during the war. Part of the population was living a life of luxury with fancy clothes, cruises, the arts, like jazz music and dance.

The Roaring Twenties was also a period of emancipation for women, who took ownership of their bodies by wearing make-up, smoking in public or cutting their hair short. Tomboy women became a sensation.

Portrait taken by photographer Walery in 1926

Source: Fernande, Wikimedia Commons

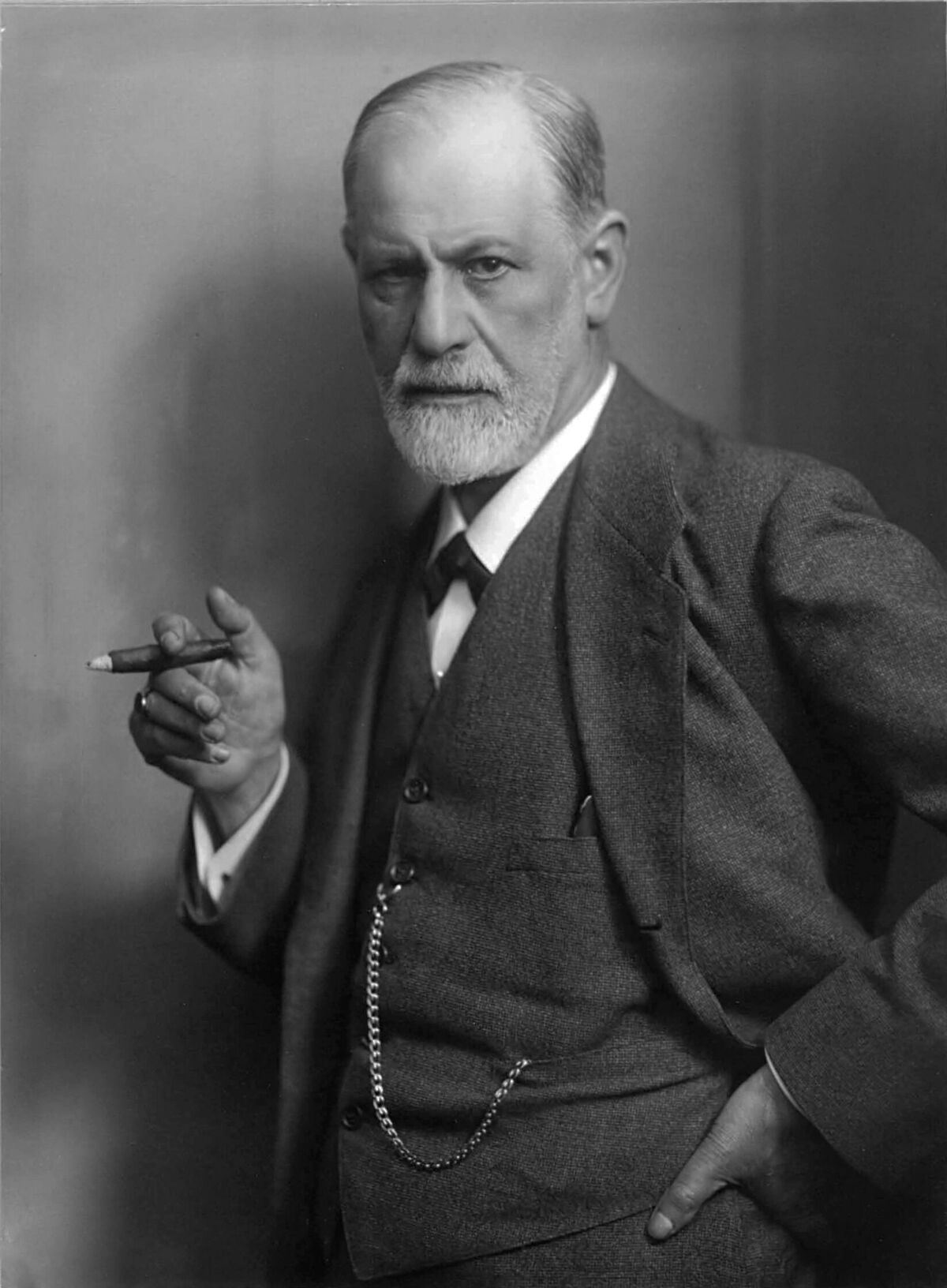

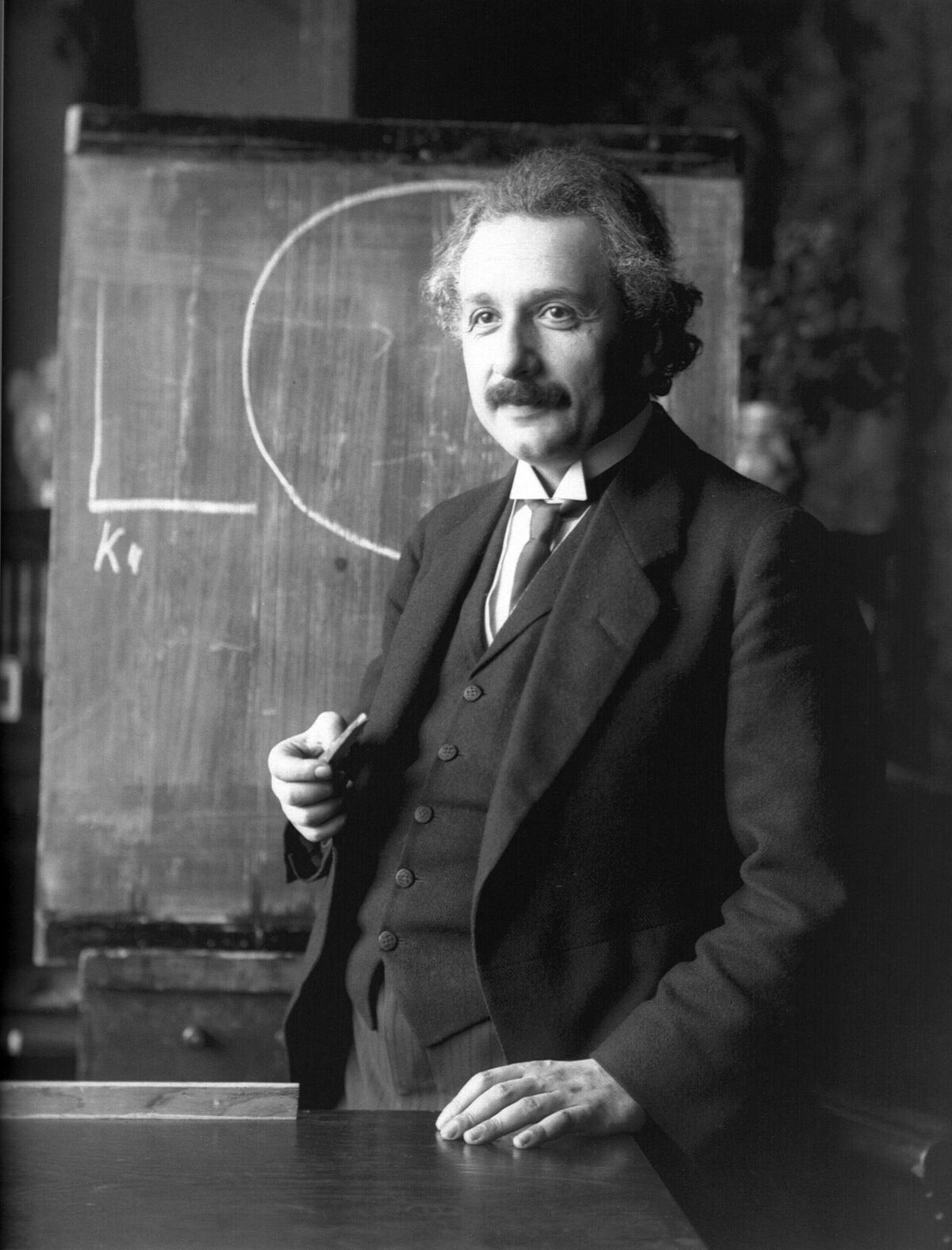

In science, during the early 20th century, Sigmund Freud experimented with his theories on the subconscious and psychoanalysis, and Albert Einstein revolutionized science with his theory of relativity.

By Max Halberstadt, photographer

Source: JasonAQuest, Wikimedia Commons

By Ferdinand Schmutzer, photographer

Source: Yann, Wikimedia Commons

The US economy had major impacts on the Western world. The US economic model was applied throughout Europe. The industrial production system benefited from Taylor’s organization of work and consumers were able to buy and invest on credit, meaning they could borrow money to buy or invest.

The United States’ prosperity had been increasing since the end of World War I. The major European empires were hit hard by the impacts of this Great War and they struggled to rebuild their economies. This led the US economy to become a major part of the global economy. The country’s production was progressing quickly. American products were sold all over the world, making the US economy very rich and one of the world’s leading economies.

Prosperity refers to when a state enjoys strong economic development and a favourable financial situation.

Despite this unprecedented growth, US leaders implemented protectionist measures to create barriers to trade with other countries.

From 1925 onwards, the mechanization of farming resulted in overproduction. Small-scale agricultural producers experienced significant wage cuts, causing many of them to leave the countryside and move to the city. The rural exodus was so strong that an estimated 60 000 people left the countryside each year.

Overproduction wasn’t the only agricultural problem. Other industries were affected and experienced a production surplus. This happened with the automotive industry in 1928. With supply exceeding demand, markets had large surpluses. However, exports still made it possible for these surpluses to be sold abroad. The increase in US-produced goods peaked in 1925.

Oldsmobile was an automobile producer in the 1920s.

Source: Science, Industry and Business Library: General Collection, The New York Public Library. (1928). 1928 - Oldsmobile - Model F-28, Landau Sedan, 6 cylinder.

In 1926, the economic situation began to show signs of weakness. Growth was too fast, credit was disorganized and consumers and leaders had absolute faith in liberalism. So, the government didn’t intervene in the economic system.

Speculation was on the rise. Investors borrowed money to buy shares in the stock market, hoping that prices would increase. By selling their shares, they could repay their loan and still make a profit. In 1927, due to the increased use of credit to borrow money and the export of capital abroad to invest money outside the United States, banks had no choice but to raise their interest rates.

-

Speculation is the act of making financial transactions by trying to predict prices in order to profit from market fluctuations. This can involve buying stocks when prices are low and selling them when prices are high to make a large profit.

-

Stocks are ownership titles that represent a portion of a company’s capital.

-

Capital is the assets or money owned by a person, company or state. Capital can be used to make investments.

-

The interest rate refers to the amount a person or institution has to pay to access a loan. This amount is calculated as a percentage.

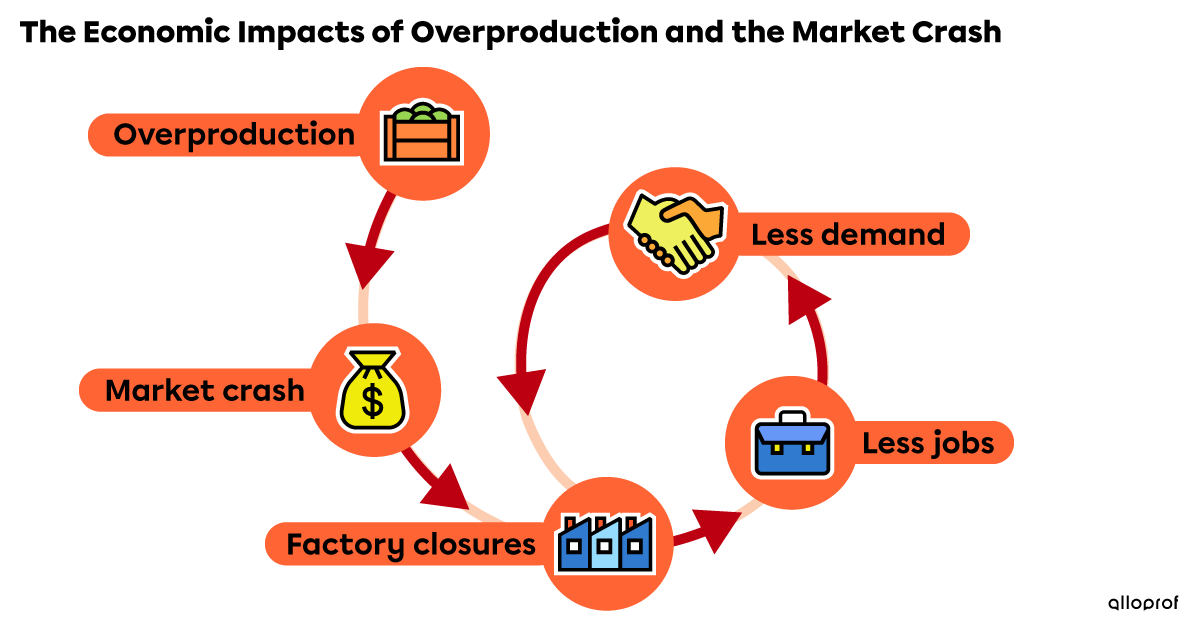

Factories produced more than the population could buy. Stocks of available products rose, while industrial production fell sharply, leading to lower prices and profits. Spending in construction fell and auto sales dropped, followed quickly by other areas of production. Meanwhile, foreign trade was still limited by protectionist measures, which did not help surplus stocks sell. Consumers and financial institutions gradually lost confidence and were reluctant to invest again.

Despite the government’s attempt to correct the situation by imposing price decrees and introducing public works programs to keep employment up, the situation worsened. The day before the economic crisis, the stage was set for a stock market crash, which started on October 24, 1929.

When investors noticed production declining, they began to sense that the value of their shares wouldn’t keep going up. This prompted many investors to sell their shares. The number of shares for sale reached a record high on Thursday, October 24, 1929. On that day, almost 13 million shares were for sale on the Wall Street Stock Market.

The supply was enormous while the demand was decreasing. Prices fell rapidly because no one was buying the shares. The Wall Street Stock Market collapsed on Thursday, October 24, 1929, known as Black Thursday.

The drop in share prices continued over the following days, causing investors to panic so much that by Tuesday, October 29, 1929, 33 million shares were sold.

For a week, shares were sold at very low prices. No one wanted to buy shares that were going down in price. Prices continued to fall until late November 1929.

American society entered what would become a long economic depression that had a major impact on the global economy.

Investors were the first people affected by the stock market collapse. Most of them borrowed money to invest in the stock market. The fire sale of their shares didn’t earn them enough money to repay the loans they had borrowed from the banks. Since investors couldn’t repay their loans, many banks went bankrupt because they no longer had enough funds to stay in business.

People who had put their savings in banks lost faith in the economic system and wanted to withdraw all their assets. Several banks were unable to keep up with all the withdrawal requests and declared bankruptcy.

The poor economic situation caused consumption (the demand for goods and services) to fall drastically. This caused companies to stop producing goods. Industrial production rapidly collapsed. The prices of factory-made goods and agricultural products fell soon after.

Unemployment refers to a period of time when a person is without work, but is able to work and is actively seeking employment.

As factories closed down, thousands of employees lost their jobs. Within a few months, at least 13 million people were unemployed in the United States. This represented 25% of the labour force, or one in four workers.

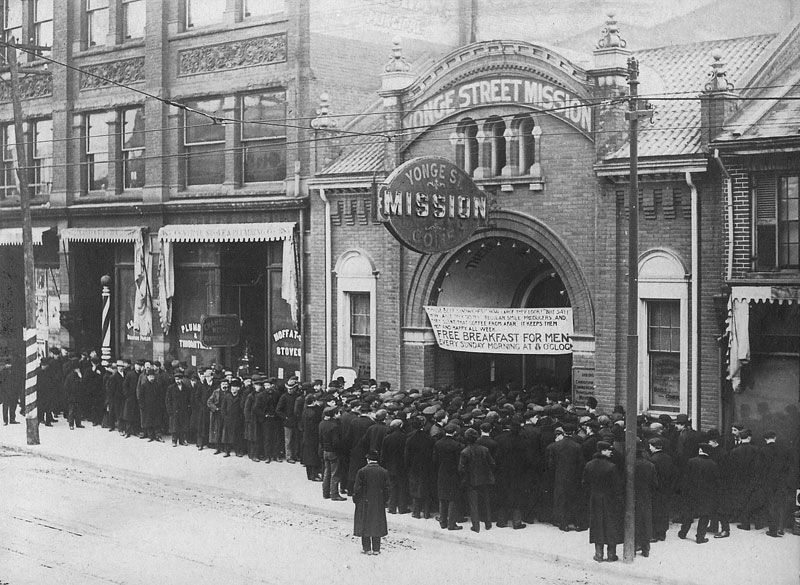

There was no unemployment insurance at the time. To survive, unemployed people had to turn to public charities, such as soup kitchens.

Because US industrial production played an important role in international markets, the US crisis spread rapidly throughout the industrialized world. For example, unemployment hit the population in Germany as hard as in the United States. This increased the popularity of Adolf Hitler and his ideology.

The US crisis also caused a sharp decline in exports. As a result, countries whose economies depended on US production were ruined. At the same time, US investors took back the capital (money) they had invested abroad. Consequently, foreign banks were affected by the crisis and this led to further bankruptcies.

At the time of the Great Depression, the reference currency was the British gold standard, but following all the bankruptcies, British currency rapidly lost value. As a result, all currencies whose value was set according to the gold standard were also devalued. The decreased value of the reference currency, declining exports and bankrupt banks practically put an end to world trade.

As the reference currency was abandoned, various countries rallied around several other reference currencies. North American countries united around the US dollar, while the United Kingdom and its empire used the pound sterling. Other countries resorted to the value of gold. This fragmentation caused the entire network of economic relations between countries to fall apart. The international monetary system collapsed, with serious repercussions.

The international monetary system refers to anything that affects how the currencies of different countries interact, such as currency exchange rates. It also affects the movement of capital (the movement of money) between states and the elements that enable credit (the borrowing of money). In short, this term broadly includes financial transactions between states.

Given all the impacts of the economic crisis, the situation did not improve. Consumption, investment and production all faced a downturn. The economic crisis then became an economic depression.

Economic problems have many impacts. In the United States alone, at the beginning of the economic crisis, 85 000 companies went bankrupt, 25% of the labour force was still unemployed and 2 million Americans were homeless. The flow of credit was limited, which made it difficult to borrow money.

The longer the economic crisis went on, the more difficult the social situation became, leading to social unrest, widespread discontent, suicide and unemployed people roaming the streets.

Source: (The Depression) The Single Men's Unemployed Association parading to Bathurst Street United Church [Photograph], around 1930, Library and Archives Canada, (URL).

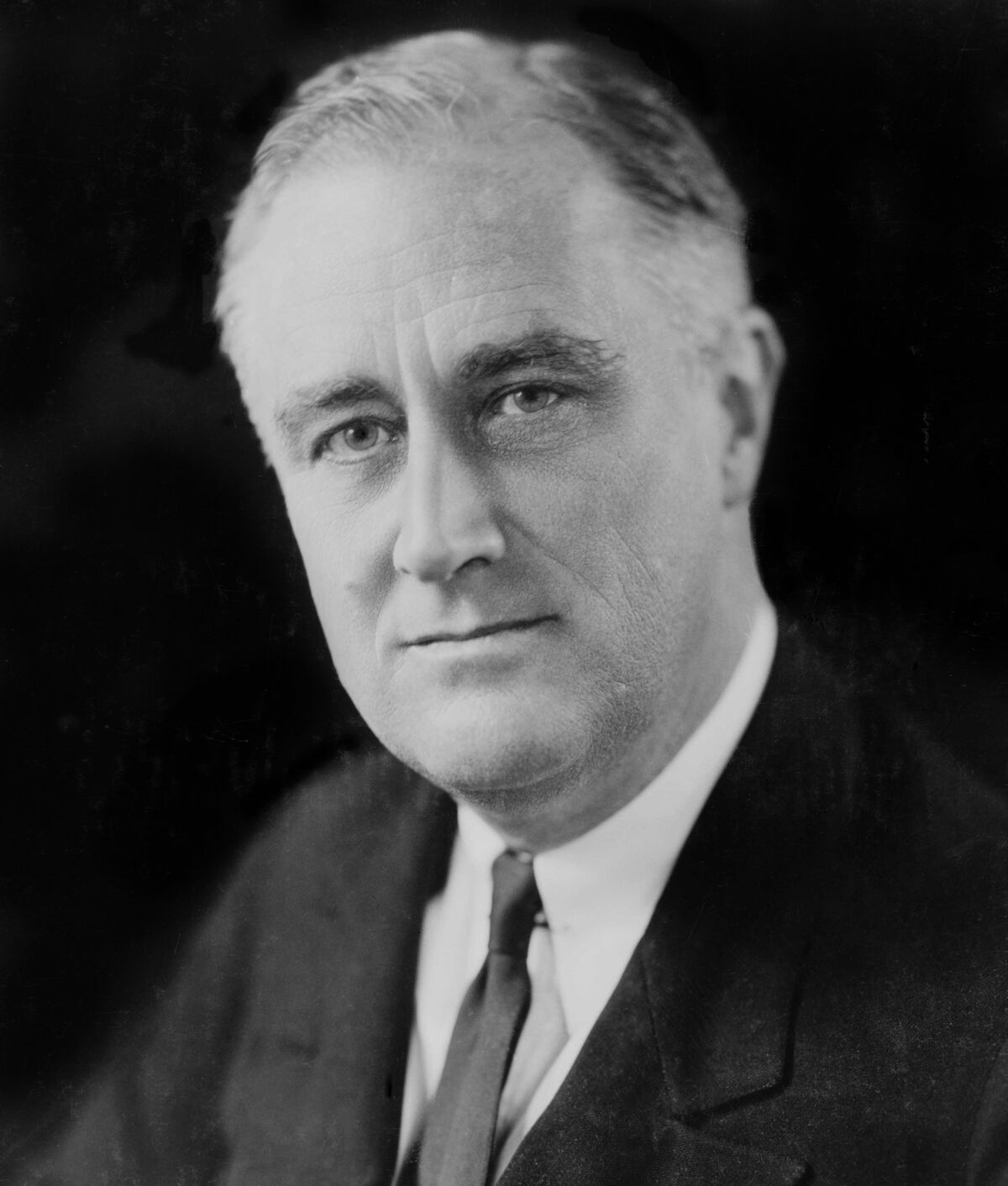

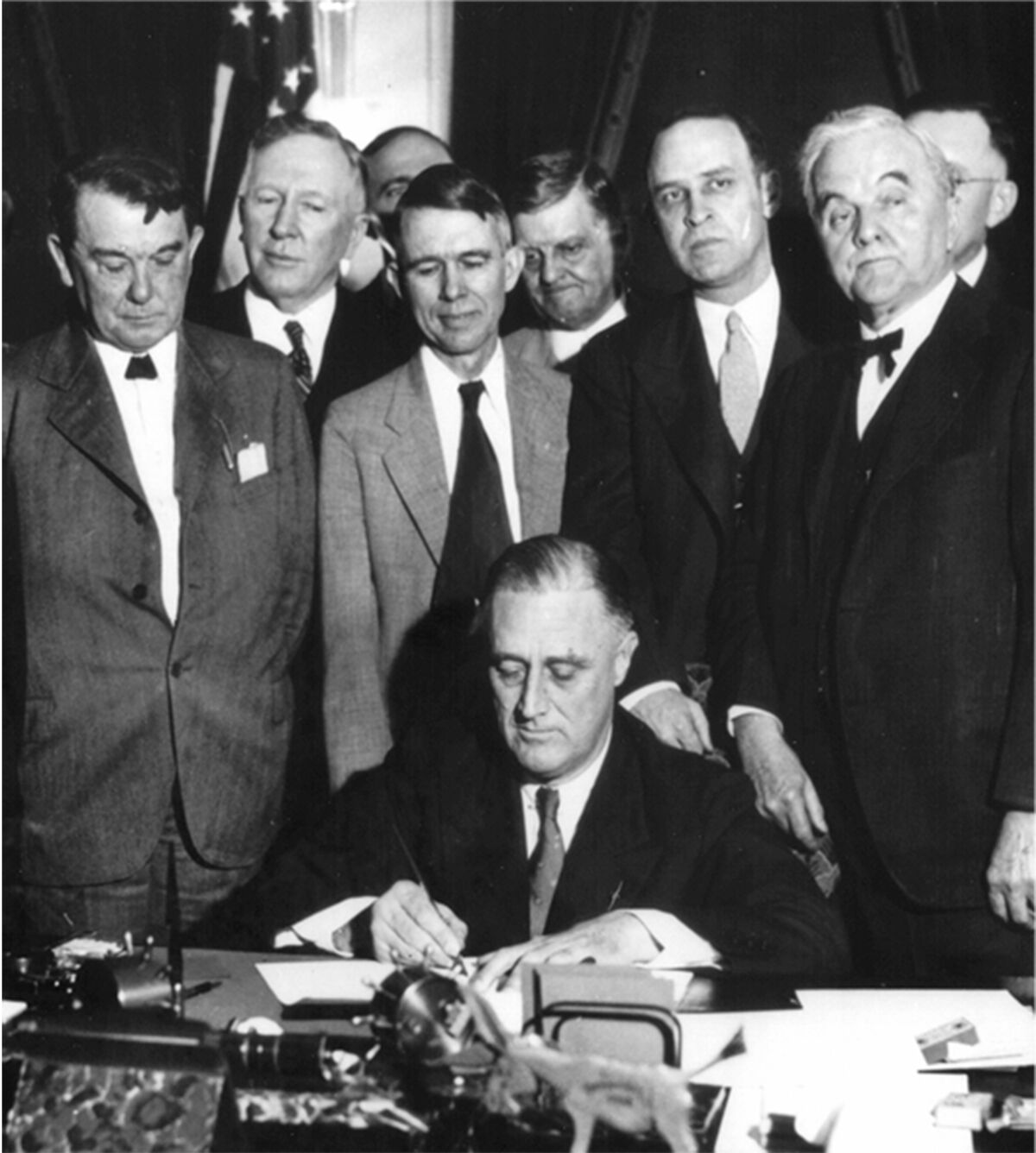

US President Herbert Hoover, who served from 1929 to 1933, tried to introduce emergency measures. However, the president was confident that business would pick up on its own. In the midst of the depression, the 1932 elections brought a new president, Franklin D. Roosevelt, to power.

When Roosevelt entered the White House, he implemented a series of reforms and national programs called the New Deal. These programs were created to reduce the negative impacts of the crisis by adding rules to the banking sector to prevent another collapse like the one that occurred in 1929 and by setting up assistance programs for widows and the elderly.

Source: Franklin Delano Roosevelt [Photograph], Hound, P., 1933, Wikimedia Commons, (URL). CC BY 3.0.

The Tennessee Valley Authority is an organisation set up to support economic development in the Tennessee Valley, a region severely affected by the economic crisis.

Source: Huntster, Wikimedia Commons

President Roosevelt also launched several infrastructure construction projects such as roads, hydroelectric dams and bridges to give jobs to the unemployed. Several of these infrastructures are still in use today.

Canada also put measures in place to help the economy recover. To learn more about this topic, see the concept sheet on Questioning Capitalism.

It is hard to distinguish between the impact the New Deal had on ending the crisis in the United States and the effects of the war economy set up during World War II. So, it is not simple to determine what exactly ended the Great Depression. The New Deal had only been active for 2 years when World War II broke out.

The war economy and the arms industry played a major role in the global economy’s recovery. Germany and Italy established major weapons and national construction programs, helping them recover from the economic crisis even before the war began. In the United States, the war helped put an end to the crisis as it boosted industrial production, which created jobs and wealth in the country. The war-time economy also boosted Canada’s economy.

The Great Depression was the most serious economic crisis of the 20th century. Its enormity made people question capitalism. Communist countries were not affected by the crisis, which served as an argument for this political and economic regime.

After the crisis, governments started to intervene in the economy to prevent future catastrophic stock market crashes. A new economic model was developing to replace pure economic liberalism. This crisis also led states to develop social measures such as unemployment insurance and social security. Since then, the capitalist system has become more regulated and better organized by the government, institutions and unions.

Even today, the root causes of the Great Depression are up for debate. Economists who advocate for government involvement in the economy argue that the crisis was caused by its lack of involvement. On the other hand, economists who favour liberalism without government involvement argue that government involvement at the time caused the crisis.

Library and Archives Canada. (around 1930). Membres de la Single Men's Unemployed Association se dirigeant vers l'Église unie de la rue Bathurst [Photograph]. https://www.bac-lac.gc.ca/eng/CollectionSearch/Pages/record.aspx?app=fonandcol&IdNumber=3630097

Hound, P. (1933). Franklin Delano Roosevelt [Photograph]. Wikimedia Commons, https://commons.wikimedia.org/wiki/File:FDR_in_1933_edit.jpg

Science, Industry and Business Library: General Collection, The New York Public Library. (1928). 1928 - Oldsmobile - Model F-28, Landau Sedan, 6 cylinder [Photograph]. https://digitalcollections.nypl.org/items/510d47db-bac2-a3d9-e040-e00a18064a99