Problems involving calculating taxes and discounts are common in mathematics. Before presenting the different types of problems and the methods for solving them, it is important to understand that these situations involve money and that some rounding is required.

When calculating taxes and discounts, it is important to round the result of the calculations to the nearest hundredth.

In Quebec, two taxes are applied to most purchases. These two taxes are added to the price.

The Goods and Services Tax (GST) is a tax collected by the country on most goods and services purchased.

The Quebec Sales Tax (QST) is a tax collected by the province of Quebec and is also applied to the majority of purchases of goods and services.

For example, since 2015 the tax rate of the GST in Canada has been |5\ \%|, whereas, at the provincial level, the QST amounts to |9.975\ \%|. These rates are subject to change depending on the economic situation of the country and the province.

There are several ways to calculate the final amount of our bill, including taxes. The following are two methods. They are referred to as calculating the percentage of a number.

In this method, the two taxes are calculated separately and then added to the original amount.

-

Calculate the GST |(5\ \%)| from the base amount.

-

Calculate the QST |(9.975\ \%)| from the base amount.

-

Calculate the total amount by adding the taxes to the base amount.

The wooden pencil costs |$2.00| before taxes. What is the price of the pencil including taxes?

-

Calculate the GST from the base amount

We must calculate |5\ \%| of |$2.00.|

||\begin{align}5\:\%\times $2.00\:&=0.05\times $2.00\:\\ &=$0.10\:\end{align}|| Therefore, the amount of the GST is |$0.10| (i.e., |10\:¢|) -

Calculate the QST from the base amount

We must calculate |9.975\ \%| of |$2.00.|

||\begin{align}9.975\:\%\times $2.00\: &=0.09975\times $2.00\:\\ &=$0.1995\:\\ &\approx$0.20\:\end{align}|| Therefore, the amount of the QST is |$0.20| (i.e., |20\:¢|). -

Calculate the total amount by adding the taxes to the base amount

The total amount results in ||$2.00+$0.10+$0.20=$2.30|| The pencil will cost |$2.30.|

In this method, first calculate the percentage for the total amount (with taxes).

-

Calculate the percentage that represents the amount including taxes.

-

Calculate the final amount using the percentage.

Go back to the example with the |$2.00| wood pencil.

-

Calculate the percentage that represents the amount including taxes

The basic amount of the pencil corresponds to |100\ \%.|

The GST corresponds to |5\ \%| and the QST to |9.975\ \%|.

Therefore, the percentage for the amount including taxes is: ||100\ \%+5\ \%+9.975\ \%=114.975\ \%|| -

Calculate the final amount using the percentage

Calculate |114.975\ \%| of |$2.00.|

||\begin{align}114.975\:\%\times $2.00\:&=1.14975\times $2.00\:\\&=$2.2995\:\\ &\approx $2.30\:\end{align}|| Note that the same result is obtained as with method 1.

In several problems, the percentage of taxes will be rounded to |15\ \%.| It makes the calculations easier and makes it possible to estimate the total amount of the invoice using mental math.

It is possible to mentally calculate the tax: the answer is not exact, because it is an approximation.

There are two taxes in Quebec: the GST |\left(5\:\%\right)| and the QST |\left(9.975\:\%\right).| When the taxes are added together, |14.975\:\%| is obtained.

To make calculating the approximate amount of taxes easier, the percentage can be rounded to |15\:\%.|

To mentally calculate the amount of taxes, proceed as follows:

Il est possible de calculer mentalement la taxe. La réponse n’est pas parfaite puisqu'il s'agit d'une approximation.

Il existe deux taxes au Québec : la TPS |\left(5\:\%\right)| et la TVQ |\left(9{,}975\:\%\right).| Quand on additionne ces taxes ensemble, on obtient |14{,}975\:\%.|

On peut arrondir ce pourcentage à |15\:\%| pour calculer plus facilement le montant approximatif associé aux taxes.

Pour calculer mentalement le montant associé aux taxes, on procède de la façon suivante.

-

Find |10\ \%| of the amount by moving the decimal point one place to the left.

-

Divide this number in half to find |5\ \%| of the amount (|5\ \%| is half of |10\ \%|).

-

Add the two numbers obtained to get the approximate amount of tax.

The price of a sweater in a boutique is $19.95.

Estimate the total cost with taxes using the 3 steps. To make it easier, round the price of the sweater to $20.

-

Find |10\ \%| of the price by moving the decimal point one place to the left

||$20.00\: \Rightarrow $2{\color{red}{.}}000\:=$2|| -

Divide this number in half to get |5\ \%| of the price (|5\ \%| is half of |10\ \%|)

||$2\:\div2=$1|| -

Add the two numbers obtained to get the approximate amount of tax that will be added to the price

||$20\:+$2\:+$1\:=$23||

The resulting estimate of the price (with taxes) is |$23.| The precise calculation of the taxes would be |$22.94.| The estimate is very close.

Calculating a discount uses the same principle as the one used to calculate the tax; it comes down to calculating the percentage of a number. However, rather than adding an amount to the base price (like with taxes), the price is reduced by a certain amount.

Two methods, similar to the ones for calculating taxes, are presented below.

In this method, the discount is calculated and then subtracted from the base amount.

-

Calculate the dollar value of the discount from the percent discount.

-

Subtract the dollar value of the discount from the base amount.

The lamp is worth |$15.00,| but the store is offering a |20\ \%| discount applicable today only. What will the price of the lamp be after the discount?

-

Calculate the dollar value of the discount from the percentage discount

We must calculate |20\ \%| of |$15.00.|

||\begin{align}20\:\%\times $15.00\:&=0.20\times $15.00\:\\ &=$3.00\:\end{align}||

Therefore, the discount on the lamp is |$3.00.| -

Subtract the monetary value of the discount from the base amount

||$15.00\:-$3.00\:=$12.00\:||

Thanks to the discount, the price of the lamp is |$12.00| instead of |$15.00.|

In this method, the percentage that represents the amount after the discount is calculated first.

-

Calculate the percentage that represents the amount after the discount.

-

Calculate the price after the discount using the percentage.

Take the example of the |$15.00| lamp with a |20\ \%| discount.

-

Calculate the percentage that represents the amount after the discount

The base amount of the lamp corresponds to |100\ \%.| The discount corresponds to |20\ \%.|

Therefore, the percentage representing the amount after the discount is calculated as follows.

||100\:\%-20\:\%=80\:\%|| -

Calculate the amount after the discount using the percentage

Calculate |80\ \%| of |$15.00.|

||\begin{align}80\:\%\times $15.00\:&=0.80\times $15.00\:\\ &=$12.00\:\end{align}||

Note that the result obtained is the same as with method 1.

Certain problems ask to calculate the new cost after applying a discount and the taxes to the original price. Several methods can be used. One is presented here.

-

Calculate the amount after the discount using the original price and the percentage discount.

-

Calculate the final price using the amount obtained in step 1 and the percentage of taxes.

From an initial amount, it is possible to add taxes first, then remove the discount from this new amount.

This is possible because of the associative and commutative property of multiplication.

However, the discount is usually calculated first.

In the following example, the GST and the QST will be rounded to |15\ \%.|

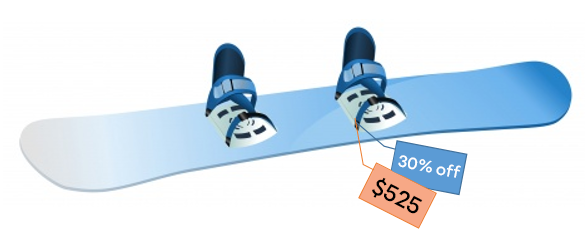

Hugo goes to a sports store to get a new snowboard. Since it is the end of the season, there is a |30\ \%| discount on everything in store. Hugo notices a snowboard that he likes. Will he be able to buy the snowboard with a budget of |$450?|

-

Calculate the amount after the discount using the original price and the percentage discount

First, calculate the amount of the discount using |30\ \%| before subtracting it from the initial amount.

||\begin{align}30\:\%\times $525\:&=0.30\times $525\:\\ &=$157.50\:\end{align}||

Therefore, the amount after the discount is: ||$525\:-$157.50\:=$367.50|| -

Calculate the final price of the invoice using the amount found in step 1 and the percentage of taxes

First, calculate the amount of taxes using |15\ \%| before adding it to the amount found in step 1.

||\begin{align}15\:\%\times $367.50\:&=0.15\times $367.50\:\\ &=$55.125\:\\ &\approx $55.13\:\end{align}||

Therefore, the total amount of the invoice is the following. ||$367.50\:+$55.13\:=$422.63||

Hugo will be able to buy the snowboard since it is within his budget.

In some problems, it is necessary to find the original price from the total amount of the bill; i.e., from the new amount once the discounts and/or taxes are applied. In the previous sections of this concept sheet, the calculations related to calculating the “percentage of a number”. In this section, however, the calculations refer to finding one hundred percent of a number.

Once again, there are several methods to find the original amount. One method is presented here.

-

Calculate the amount before taxes using a proportion.

-

Calculate the amount before the discount using a proportion from the amount found in step 1.

In some problems, the final price includes only the tax or only the discount. In such cases, the original amount can be found by applying step 1 only.

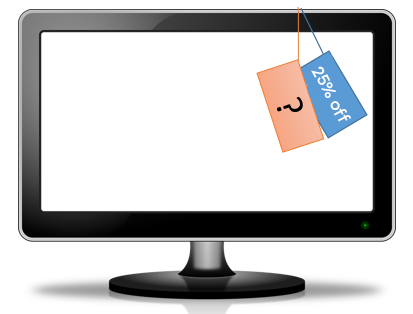

Annick buys a television for |$460.45.| The electronics store where she makes her purchase offers her a |25\ \%| discount. Find the original price of the television knowing that the price Annick will pay includes |15\ \%| in taxes.

-

Calculating the amount before taxes

Since the taxes are |15\ \%,| the percentage representing the amount after taxes, |\color{blue}{$460.45}|, corresponds to |\color{blue}{115}\ \%.| The amount before taxes corresponds to |100\ \%.|

Therefore, the following proportion is obtained.

||\dfrac{\color{blue}{115}}{100}=\dfrac{\color{blue}{$460.45}}{$?\ }|| By performing cross multiplication, the following is obtained.

||\begin{align} ?&=\dfrac{100\times $460.45}{115}\\ \\?&\approx $400.39\:\end{align}|| -

Calculate the total before the discount from the amount found in step 1

The procedure is essentially the same as in step 1.

Since the discount is |25\: \%,| the percentage representing the amount after the discount, |\color{blue}{$400.39}|, corresponds to |\color{blue}{75}\ \%.| The amount before the discount corresponds to |100\ \%.|

Therefore, the following proportion is obtained.

||\dfrac{\color{blue}{75}}{100}=\dfrac{\color{blue}{$400.39}}{$?}||

By performing cross multiplication, the amount before taxes is obtained. ||\begin{align} ?&=\dfrac{100\times $400.39}{75}\\ \\ ?&\approx$533.85\:\end{align}||

Therefore, the original amount (before the discount and taxes) was |$533.85.|